Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

[News] Controlled Market Demand Amid Earthquake Impact, Second Quarter DRAM Prices Expected to Rise by Over 20%

According to a report from TechNews, there has been a significant surge in demand in the memory market, driving prices steadily upward. This surge has led to the latest quotations from Korean memory manufacturers, with DDR5 prices set to increase by 13% in May.

Additionally, DDR4 prices are also expected to rise by 10%. As for DDR3, which currently serves as the main supply for Taiwanese memory manufacturers, there is also room for a 10% to 15% increase. Overall, contract prices for the second quarter are anticipated to rise by 20% to 25%.

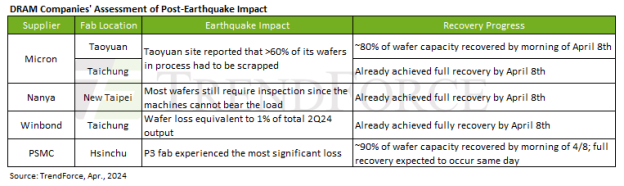

Following in the wake of an earthquake that struck on April 3rd, TrendForce undertook an in-depth analysis of its effects on the DRAM industry, uncovering a sector that has shown remarkable resilience and faced minimal interruptions. Despite some damage and the necessity for inspections or disposal of wafers among suppliers, the facilities’ strong earthquake preparedness of the facilities has kept the overall impact to a minimum.

Leading DRAM producers, including Micron, Nanya, PSMC, and Winbond had all returned to full operational status by April 8th. In particular, Micron’s progression to cutting-edge processes—specifically the 1alpha and 1beta nm technologies—is anticipated to significantly alter the landscape of DRAM bit production. In contrast, other Taiwanese DRAM manufacturers are still working with 38 and 25nm processes, contributing less to total output. TrendForce estimates that the earthquake’s effect on DRAM production for the second quarter will be limited to a manageable 1%.

With the earthquake’s impact under control, for each manufacturer, Micron temporarily suspended quotations due to the earthquake’s impact on production. After completing the assessment of losses, it notified customers of a 25% increase in DRAM and SSD contract prices.

Additionally, due to Samsung’s production line conversion, the early cessation of DDR3 production has prompted many customers to turn to Nanya and Winbond for procurement orders, leading to the completion of product verification. As a result, Nanya and Winbond have informed customers in the second quarter that DDR3 prices are expected to increase by 10-15%.

Per TrendForce’s observations, as the three major memory manufacturers continue to transition their production capacity to highly demanded products such as HBM and DDR5, the production capacity of products like DDR4 and DDR3 has significantly decreased.

Overall, the supply-demand gap is expected to exceed 20-30% by the second half of 2024. This situation will lead to a substantial increase in DDR3 prices in the second half of the year, with price hikes reaching 50-100% as current prices remain below costs. This scenario will also be advantageous for the operational performance of various domestic memory manufacturers.

Read more

- DRAM Manufacturers Gradually Resume Production, Impact on Total Q2 DRAM Output Estimated to Be Less Than 1%, Says TrendForce

- [Insights] DRAM Spot Prices Expected to Decline Post-Manufacturer Quoting Resumption

Please note that this article cites information from TechNews.

Subject

Related Articles

Recent Posts

- [News] Controlled Market Demand Amid Earthquake Impact, Second Quarter DRAM Prices Expected to Rise by Over 20%

- [News] PSMC’s New Tongluo Plant Unveiled, CoWoS Packaging Ready to Roll

- [News] TSMC Reportedly Commences Production of Tesla’s Next-Generation Dojo Chips, Anticipates 40x Increase in Computing Power in 3 Years

- [News] HBM Craze Continues! SK Hynix Reports Sold Out for this Year, Next Year’s HBM Capacity Nearly Fully Booked

- [News] AI Chip Alone Can’t Hold Up? AMD’s Fiscal Forecast This Quarter Reportedly Falls Short of Expectations

Recent Comments

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED

- LED Backlight

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 未分類