Popular Keywords

- About Us

-

Research Report

Research Directory

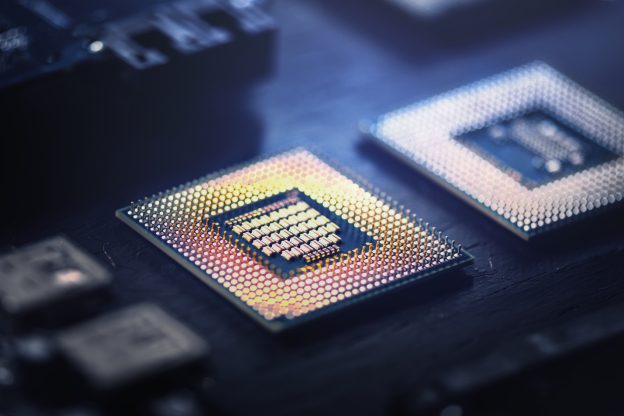

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

Consumer Electronics

News

[News] MediaTek and Xiaomi Opened a Joint Lab, the First Product with Stellar Performance Unveiled

MediaTek and Xiaomi Group have deepened their collaboration. On July 2, Xiaomi China's Vice President of Marketing and General Manager of the Redmi brand, Wang Teng, announced on Weibo that the joint laboratory between Xiaomi and MediaTek has officially opened at Xiaomi's Shenzhen R&D Center, wi...

News

[News] Rise of the Non-NVIDIA Alliance Benefits Taiwanese ASIC Manufacturers

While NVIDIA is likely to face accusations from the French antitrust regulators, the Non-NVIDIA Alliance like the UALink (Ultra Accelerator Link) Alliance and the UXL Foundation are reportedly launching a counterattack, significantly increasing their efforts in developing specialized ASICs. Accor...

News

[News] Memory Market Recovery is Near, as Winbond Expects a Good Year in 2025

According to a report from Commercial Times, Arthur Chiao, Chairman of Winbond, stated that this upward market cycle for the memory sector has arrived on time. Reportedly, customers are not worried about shortages, and all products made by Winbond will sell well all year round, boosting the momentum...

News

[News] Robust Demand in AI Drives South Korea’s Chip Exports in June to Record High

On July 1st, according to a report from Reuters, the South Korea's Ministry of Trade, Industry and Energy has announced that exports had grown for the ninth consecutive month in June. The sustained and even increasing demand for chips overseas led to a record high in chip export value for June. Thi...

News

[News] iPhone 16 with A18 Chip Excels in Computing Power, Boosting Taiwanese Supply Chain

Apple is reportedly pushing the boundaries of AI with the upcoming iPhone 16 series, which is expected to have computational power that surpasses industry expectations. According to a report from Economic Daily News, it has suggested that Apple is developing the A18 chip for this year's iPhone 16 mo...

- Page 39

- 95 page(s)

- 471 result(s)