Popular Keywords

- About Us

-

Research Report

Research Directory

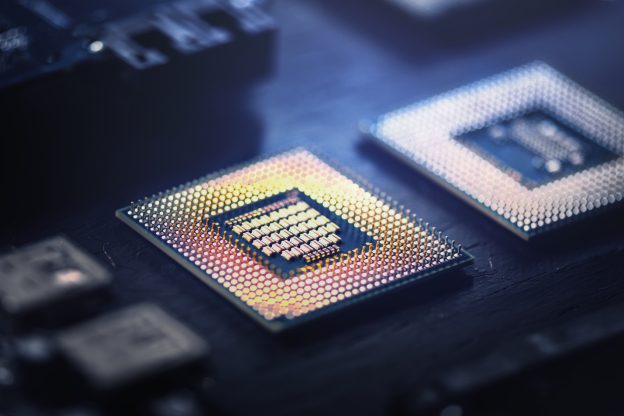

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

Articles

News

[News] MediaTek to Tape-out First 2nm Chip in September, Reportedly for Smartphone/ NVLink Custom ASIC

Following Xiaomi’s launch of its first in-house 3nm chip, XRING 01, Taiwanese smartphone chipmaker MediaTek also signals its first 2nm products at Computex 2025. According to Commercial Times, the company’s first 2nm chip is expected to tape out in September. As MediaTek deepens its partnersh...

News

[News] Foxconn Invests €250M in Europe’s First Fan-Out Wafer Level Packaging Plant

According to Economic Daily News, Foxconn announced on May 19 a EUR 250 million investment in Europe. The plan includes forming a joint venture in France with Thales and Radiall to focus on advanced semiconductor packaging and testing (OSAT), along with a strategic partnership with Thales in the sat...

News

[News] Top Five NAND Manufacturers Reportedly Cut Production by 10-15%, Fueling Q2 Price Rebound

As memory giants reportedly brace for price hikes on DDR4 and DDR5, NAND suppliers are also seeing stronger-than-expected momentum in Q2. According to Commercial Times, the top five NAND Flash makers have cut production, fueling an upswing in memory pricing. The report suggests that major NAND ma...

News

[News] Rambus Unveiled Next-Generation Memory Module, Boosting AI PC Performance

On May 14, Rambus announced the launch of a complete lineup of next-generation AI PC memory modules, specifically designed for client chipsets. This includes two new power management IC (PMIC) tailored for client-side computing: the PMIC5200 for LPDDR5 CAMM2 (LPCAMM2) memory modules and the PMIC5120...

News

[News] Xiaomi Confirms 3nm SoC, Commits $6.9 Billion to Chip Development Over 10 Years

Xiaomi recently drew widespread attention after announcing its self-developed smartphone SoC, the XRING 01. According to Chinese media outlet Ming Pao, Xiaomi CEO Lei Jun revealed on Weibo on May 19 that the chip is manufactured on a 3nm process—marking the first time a Chinese firm has successf...

- Page 63

- 682 page(s)

- 3409 result(s)