Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

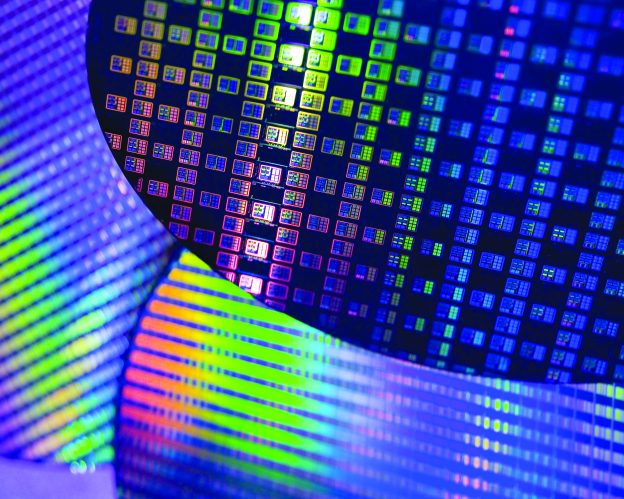

[News] Fabs Reportedly Depleting Inventory, Silicon Wafer Orders Expected to Resume in H2

Fab inventories have declined for two consecutive quarters, indicating that reducing excess stock may currently be the semiconductor industry’s top priority. According to industry sources cited in a report from Commercial Times, fabs are predicted to wait until the second half of 2024 to resume ordering silicon wafers.

According to the latest quarterly analysis report from SEMI, a major microelectronics association, global silicon wafer shipments in the first quarter of 2024 reached 2,834 million square inches (MSI), marking a 5.4% decrease from the previous quarter and a 13.2% decrease from the same period last year.

SEMI attributes this decline in silicon wafer shipments to the continuing decline in IC fab utilization and inventory adjustments. Consequently, shipments of silicon wafers of all sizes experienced negative growth in the first quarter of 2024.

Industry sources cited by the same report note that, based on recent trends in foundry orders, apart from TSMC, other semiconductor manufacturers have seen capacity utilization rates around 70%. Among these, DRAM and Flash memory wafer shipments have shown year-on-year increases of 20.3% and 1%, respectively, indicating better performance compared to previous periods.

Japanese silicon wafer manufacturer Sumco recently announced in its financial report that in the first quarter, overall demand for 12-inch silicon wafers had bottomed out. Demand for logic chips used in AI and DRAM had increased. However, for applications outside of AI, customers continued to adjust their production.

Sumco estimates that due to customer production adjustments and the recovery of silicon wafer demand, it may take until the second half of 2024 for the situation to improve.

Industry sources cited by Economic Daily News believe that most IC design companies have returned to normal days of inventory (DOI) and are prioritizing urgent orders for foundries. However, the inventory levels of fabs and memory fabs remain historically high, so they will primarily focus on digesting existing long-term contracts (LTA) in the short term.

Read more

(Photo credit: TSMC)