News

Ahead of TSMC’s earnings call, Dutch chipmaking tool giant ASML flagged the impact of looming U.S. tariffs, reporting weaker-than-expected Q1 results and warning of a slight dip in Q2 sales, according to Reuters, CNBC and the company’s press release.

Reuters, citing ASML CEO Christophe Fouquet, notes that the tariffs will add uncertainty to the company’s 2025–2026 outlook, though growth is still expected with AI-related demand remaining robust.

ASML reaffirms its 2025 sales outlook at €30–35 billion, trimmed from an earlier target of up to €40 billion. However, CNBC, citing Fouquet, warns that uncertainty with some of the company’s customers could push full-year revenue toward the lower end of its guidance range.

Notably, ASML’s net bookings for Q1 2025 reached €3.9 billion ($4.4 billion), falling short of analysts’ estimate of €4.89 billion, according to data cited by Reuters.

China’s Share Slips to 27% in Q1

It is worth noting that ASML projected that in 2025, sales from China would decrease to 20% of its total revenue, according to a previous report by CNBC. In the first quarter, 2025, China contributed 27% of its total sales, down from 47% in the third quarter of 2024.

Reuters reports that ASML has been barred from selling most of its advanced EUV and DUV lithography tools to China under U.S. and Dutch export restrictions dating back to Trump’s first term. With Trump set to unveil more semiconductor tariff details later this week, chipmakers face growing uncertainty.

The Dutch semiconductor firm reported total sales of €7.7 billion in Q1, slightly lower than the expected €7.8 billion, with a gross margin of 54.0% and a net income of €2.4 billion, as per CNBC.

Looking ahead, ASML projects Q2 2025 net sales to range between €7.2 billion and €7.7 billion, with a gross margin expected to be between 50% and 53%.

Read more

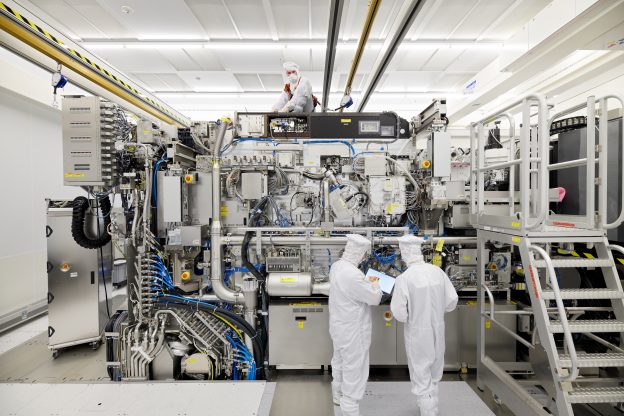

(Photo credit: ASML)