Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

LEDinside: China’s residential lighting market surpasses US$ 800M in 2013

Starting from 2012-2014, bans on incandescent lights has led to the gradual entry of LED products in the residential lighting markets, according to a latest search report by LEDinside, a research division of TrendForce. Improved LED luminous efficacy and lowered LED product prices contributed to higher consumer acceptance levels and rising penetration rates. Japan was the largest LED residential lighting market in 2012, followed by Europe and North America. However, China’s residential lighting’s global market share is also growing.

China’s LED residential lighting market will reach US$ 5941 million in 2013, with LED residential lighting accounting for US$ 814 million, and taking a 24% share of the overall global market. The LED residential lighting market development in other regions including Europe, U.S., Japan, Taiwan and emerging markets is also being spurred by establishment of policy standards, and manufacturers promotion of product and pricing strategy.

In North America, a increase in new home sales and arrival of LED lamp sweet point are powerful driver force to support the U.S. LED residential lighting market growth. Establishment of luminaire standards, such as Energy Star and others are directing the market towards standardization. In addition, top manufacturers including Cree, GE, and Philips are acquiring market share and shaping industry development with expanded product lines and releases of new products with high price /performance ratio.

Affected by ban on incandescent lamps, Europe’s LED lighting market competition has intensified. LED lamps Average Selling Prices (ASP) continued to plunge, while more lighting products with intelligence control system features are entering the market. For instance, Philips has launched Hue LED lamps using WiFi to control and switch light color. Osram is also using lighting control systems from subsidies to integrate LED lighting with intelligent control systems.

In 2012, Japan’s LED bulb shipments reached 27.9 million and estimated to grow to 28.5 million in 2013. Japanese lighting manufacturers are develop new business strategies, due to fierce pricing competitions in the bulb market and gradual market saturation. Japanese manufacturers are differentiating their products in the market by focusing on high power LED lamps and high performance products, developing ceiling lights, or expanding into emerging markets including Vietnam and Taiwan.

China has extended its 2013 SSL product fiscal subsidies to 30 million lights, including residential lighting products. However, the average Chinese consumers understanding of LED lamps remain limited, with only 25% of surveyed accurately identified LED bulbs, according to a recent LEDinside Chinese market survey. Therefore, before Chinese LED lighting manufacturers can tap into the general residential lighting market, consumer education is required to improve understanding.

In 2012, Taiwan’s LED bulb shipments reached 1.34 million and estimated to grow 20% in 2013 to 1.61 million. Major Taiwanese LED bulb manufacturers include Everlight Electronics Co., Delta Electronics, and Top Energy Saving System Co. (TESS). In addition, Toshiba and Philips are also actively expanding into the Taiwanese market. In 2013, manufacturers promoted brand new lamp specifications that emphasize omni-directional lighting and Color Rendering Index (CRI).

【Lighting Market Trend – Residential lighting market trend】

According to LEDinside, observed from the 2013 regional residential lighting market development, the Chinese market proportion will increase from 19% in 2012 to 24%, becoming the fastest-growing regional market. In terms of the European market, the implementation of comprehensive ban of incandescent lamps and the economic recovery after the European debt crisis gradually had a positive impact onLED light bulb market, and the LED light bulb market penetration rate is expected to increase.

In view of the users and using habits of LED lighting products, LED lighting can bring more energy efficiency compared to conventional lighting. Hence, LED lighting penetration rate increases more quickly in commercial lighting, industrial lighting and outdoor lighting, because energy-saving demand in those applications is higher, and all users are professional.

Residential LED Lighting Market in 2012

Source: LEDinside

Residential lighting is mainly targeted for the general consumers, except that their awareness of the LED lighting is not high, they are more sensitive to the initial investment cost. Therefore, LED lighting penetration rate of residential lighting relatively lags behind that of other application areas.

In contrast to LED commercial lighting, LED residential lighting is characterized by diverse consumers that are more sensitive to prices; lower power products are needed; and low gross profits for lighting manufacturers. Therefore, as LED lighting becomes popular, manufacturers need to carefully develop each market segment and consumer habits, and stringently control costs and product quality. Especially, in the beginning when prices decline rapidly and consumer habits are constantly changing, manufacturers can easily miss out opportunities to quickly establish sales channels and product popularity if they do not use low price strategies to enter the market.

【Automotive Lighting Market Development Trend- Trends in the LED Rear Combination Lamp (RCL) Market】

RCL composes of tail lights, brake lights and direction lights. Regulations require high brightness for brake and direction lights, while tail lights require lower brightness.

Taking into consideration factors such as cost and aesthetics, the majority of RCL design is composed of conventional lamps and LEDs. Market share of the design with conventional amp and LEDs gradually decreased in 2013, while shares of RCL using solely LEDs increased.

2011 LED For RCL Application (Volume)

Source: LEDinside

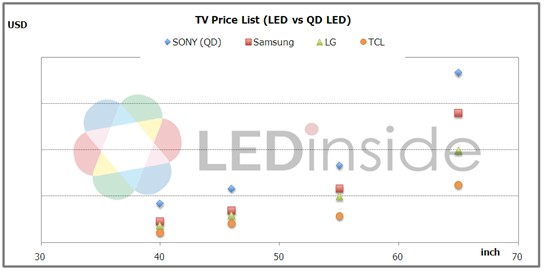

【LED Backlight Market Development Trend- Analysis of Second Generation LED TV’s Added Value And New LED Materials】

Quantum dot became an important new LED technology that display and package manufacturers are focused on in 2H13 and 1H14 to create market segmentation, and improve color saturation by using either QD LED tubes or optical films. Under the pretext of competitive pricing in display applications, it’s important for companies to lower product costs. For example, manufacturers should reduce the costs of 4K2K TV to 1.3 times or below the price of same sized HD TV, and control the price of QD TVs at 1.5 times or below of HD TV. This measure can greatly increase sales performance.

TV Price List (LED TV v.s. QD TV)

Source: LEDinside

LEDinside 3Q13 Silver+ Member Report Outline

[LED lighting market development – Outline]

Residential Lighting Market Outlook

- Definition of Residential Lighting

- Presentation of Residential Lighting

- Luminaries Requirements for Residential Lighting

- Lighting Scenarios Analysis

- Global LED Residential Lighting Market Dynamics – Regional Proportion of Production Volume

North America

- Market Overview – LED Penetration Rate in North America, Observation of North American Residential Lighting Market from New Home Sales

- The Bulb Prices in U.S. Show The Fluctuation Trend, And Have Reached A Sweet Point

- Policies – Energy Star, Title 24

- Manufacturers’ Trends – 40W / 60W LED Bulb Pricing Strategy

Europe

- Market Overview – European Residential Lighting Market Analysis, European Incandescent Lamps Ban Policy Influence—Chinese LED Lamps Exports To Europe, and Development of European LED Manufacturers

- Policies – European LED Residential Lighting Certification Standards, EU Energy Directive 20-20-20 Goals & 2011 Energy Efficiency Plan

- Manufacturers’ Trends – IKEA, Philips, Osram, Zumtobel

Japan

- LED Light Bulb – LED Bulb Shipment in 2012 and 2013, Analysis Of LED Bulb Price Trends And Market Share

- LED Bulb Pricing Strategy – 40W/ 60W Equiv. LED Lamp Pricing Strategy

- Lighting Manufacturer’s Future Strategy – Three Major Strategies of Lighting Manufacturers’ Development (Panasonic, Toshiba, Sharp, Toshiba, Hitachi, Iris Ohyama)

China

- Market Overview – Analysis of China’s Residential LED Lighting Market Scale And Estimations Of LED Penetration Rates, In 2013, Fiscal Subsidies Were Extended To 30 Million LED luminaires Including Residential Lighting Products, Obstacles of LED Residential Lighting Penetration Rate.

- Pricing Strategy – China’s 40W / 60W Equiv. LED Lamp Price Trend, Survey of China’s Main Residential Luminaire Prices, Observations of Chinese Lighting Manufacturers’ LED Lamp Pricing Strategies

- Manufacturers’ Trends – Three Main Groups in China’s Residential Lighting Market (International Brands, Domestic Conventional Lighting Brands, and Emerging Domestic LED Lighting Brands.)

- Major Manufacturers – Opple, MLS, IKEA China

Emerging Markets: Taiwan / Thailand

Taiwan

- Market Overview – Analysis And Forecast Of Taiwan’s 2012-2013 LED Bulb Shipment Volume, Top Five Ranking Taiwan LED Bulb Shipment Manufacturers, Is there Chance for LED Bulb to be Included in Grant Projects in Taiwan?

- Pricing Strategy – 40W / 60W Equiv. LED Lamp Price Trend, Taiwanese Lighting Manufacturers’ LED Lamp Pricing Strategies

Thailand

- Thailand Formulates a Five-year Power Development Plan to Promote LED Lighting

Appendix: Bulb Specification In Major Regions

USA

Europe

Japan

China

Taiwan (LED Packaging Manufacturer’s Supply Chain)

【Automotive Lighting Market Development Trend-Outline】

Car Market Demand

- 2Q13 Regional Market Performance

- Highlight In Specific Markets

RCL Development History And Driving Forces

LED Development In RCL Application

- RCL Product Development

- Differences Between Direction Type And Plane type Design

- LED Development Trend in Power and Usage Volume

Trend In Penetration Rate of Conventional Lamps And LED Lamps in The RCL Market

【LED Backlight Market Development Trend- Outline】

Analysis of Second Generation LED TV’s Added Value And New LED Materials

4K2K TV

- Can 4K2K TV Stimulate LED Backlight Market Demand?

- LED Usage Volume For 40”~84” TV

- Market Opportunity And Challenge Analysis

QD TV

- QDTV Owns Higher Color Saturation

- Current Quantum Dot Technology Solutions

- TV Price List ( LED TV v.s. QD TV)

- QD TV Strength and Weakness

EMC

- Lead Frame Solutions For 1W And Above LED In Backlight Application

- Comparison Between LED Lead Frame Material And Characteristics (PPA、PCT、EMC)

- Lead Frames In Response To LED efficiency In Backlight Application (PPA、PCT、EMC)

If you would like to know more details , please contact:

|

Taipei:

|

ShenZhen:

|

Shanghai:

|

|

|

Joanne Wu joannewu@trendforce.com +886-2-7702-6888 ext. 972 |

Kirstin Wu kirstinwu@trendforce.com +886-2-7702-6888 ext. 630 |

Sara Fan sarafan@sz.dramexchange.com +86-755-8283-8931 |

Allen Li AllenLi@trendforce.com +86-21-6439-9830 ext. 608 |

Subject

Related Articles

Recent Posts

- [News] U.S. to Double Tariffs on Chinese Solar Wafers and Polysilicon

- [News] China’s Chip Design Industry to Grow 12% in 2024, Though High Product Concentration Remains an Issue

- [News] Apple Reportedly Teams Up with Broadcom to Develop AI Chip Using TSMC’s N3P Process

- [News] U.S. Reportedly Set to Impose New AI Chip Restrictions on China Before Christmas

- [News] The Automotive Chip Market Is Emerging from the Cold

Recent Comments

Archives

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- May 2009

- April 2009

- March 2009

- November 2008

- October 2008

- September 2008

- August 2008

- March 2008

- January 2008

- December 2007

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- DataTrack-EN

- DataTrack-TW

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED Backlight

- LED Chip & Package

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Macroeconomics

- Market Today

- Market Trends

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Optical Semiconductors

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 市場日報

- 未分類

- 趨勢洞察