Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

International LED Package Manufacturers Contend for Market Share in China, says Trendforce

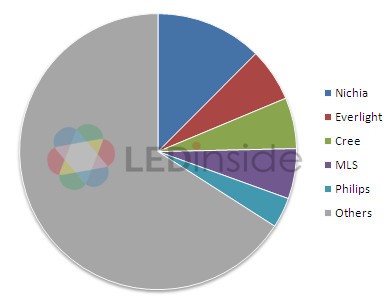

China’s LED package industry market scale reached US $7.2 billion in 2013, up 20 percent from the year before, according to the recent “2014 China Package Industry Market Report” from LEDinside, a green energy research division of TrendForce. China has become the largest manufacturer of LED products. Rapidly increasing LED lighting penetration rate is driving up LED component demand volume, making China the most contended market among LED package manufacturers. Prior to 2013, the top five companies with the largest market share in China ranked in order were Nichia, Everlight, Cree, MLS Lighting, and Philips, combined they controlled around one third of the market.

Graph 1: China LED package market share

|

Source: LEDinside

Chinese LED manufacturers rising among the ranks

Chinese LED package manufacturers began to rapidly develop in 2010 on the back of expanding upstream production capacity and downstream application market. MLS Lighting successfully ranked among the top five manufacturers with the biggest market share in the Chinese packaging market. This made MLS Lighting a leader among Chinese package manufacturers. The company developed fastest among other Chinese manufacturers, with their revenue in the LED component sector growing at a Compound Annual Growth Rate (CAGR) of 53 percent from 2010-2013. Other Chinese manufacturers including Refond Optoelectronics, Jufei Optoelectronics, and Changfang Semiconductor Light revenue increased at CAGR of 30 percent. Booming downstream application demand volumes became the development foundation for Chinese package manufacturers. LEDinside anticipates the current fast growth trend will continue over the next several years.

International LED manufacturers see most growth in China revenue

International package manufacturers revenue totaled US $2 billion in the Chinese market in 2013, an increase of 40 percent YoY due to patent advantages and benefit from the rising lighting market. Japanese manufacturer Nichia saw substantial revenue growth of over 70 percent. The company’s revenue share in China increased to 29 percent. Korean manufacturer Seoul Semiconductor also saw considerable growth, with revenue up 80 percent and revenue share increased 19 percent in China. Other manufacturers including Cree, Sharp, Philips, and Osram recorded good revenue performance in the Chinese market. Taiwanese manufacturers, however, did not share in the success. Aside from Everlight and Harvatek, Taiwanese manufacturers’ Chinese market revenue share dropped. “Chinese package manufacturers rapid rise has first impacted and threatened Taiwanese manufacturers, but has very little impact on international manufactures in the short term,” said LEDinside Analyst Allen Yu.

Chapter One: Industry Chain Overview

Chapter Two: China LED Industry Overview

Chapter Three: China LED Package Industry Overview

Chapter Four: Major Chinese LED Package Manufacturers

Chapter Five: International LED Enterprises Investment And Business in China

Chapter Six: Important Supporting Industries Related to LED Package Industry

Chapter Seven: Competitiveness of Chinese LED Package Industry

Chapter Eight: New LED Packaging Technology and Hot Topics

Chapter Nine: Conclusions and Investment Suggestions

Published Date: May 31 2014

Language: English

Format: Electronics

Page: 244

If you would like to know more details , please contact:

Joanne Wu +886-2-7702-6888 ext. 972 joannewu@ledinside.com

Subject

Related Articles

Recent Posts

- [News] U.S. to Double Tariffs on Chinese Solar Wafers and Polysilicon

- [News] China’s Chip Design Industry to Grow 12% in 2024, Though High Product Concentration Remains an Issue

- [News] Apple Reportedly Teams Up with Broadcom to Develop AI Chip Using TSMC’s N3P Process

- [News] U.S. Reportedly Set to Impose New AI Chip Restrictions on China Before Christmas

- [News] The Automotive Chip Market Is Emerging from the Cold

Recent Comments

Archives

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- May 2009

- April 2009

- March 2009

- November 2008

- October 2008

- September 2008

- August 2008

- March 2008

- January 2008

- December 2007

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- DataTrack-EN

- DataTrack-TW

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED Backlight

- LED Chip & Package

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Macroeconomics

- Market Today

- Market Trends

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Optical Semiconductors

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 市場日報

- 未分類

- 趨勢洞察