Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

Booming Infrastructure Industry Turns Southeast Asia into New Goldmine for LED Vendors, says LEDinside

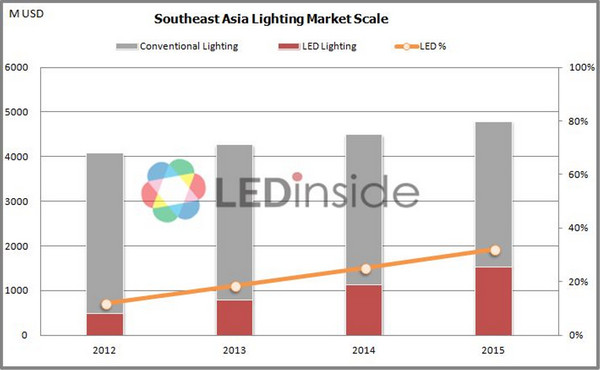

LED lighting markets in Europe, the US, and Japan have gradually matured, and China is also entering a period of intense competitions over pricing and scale. With the formation of the ASEAN Economic Community, LED vendors’ attention on the emerging markets in Southeast Asia has grown over the years. According to a recent estimation made by LEDinside, a division of Trendforce, the lighting markets of the six major Southeast Asian countries – Thailand, Singapore, Malaysia, Vietnam, Indonesia, and Philippines – had a combined value of US$4.5 billion in 2014. Out of that amount, around US$1.1 billion came from the LED lighting market. The growing infrastructure needs within the countries of Southeast Asia are expected to bring great demands for LED lighting as well.

LED lighting market grows rapidly and its market penetration rate to exceed 30% by 2015

Terri Wang, an analyst for LEDinside, said that Southeast Asia’s LED lighting market had the fastest pace of growth in 2013 with a year-on-year increase of 63%. Though growth lagged during the 2014-2015 period, the rate was kept at 30% and above. Also, the market penetration rate of LED lighting in Southeast Asia has risen with each passing year and at an accelerating speed. Overall, the market penetration rate of LED lighting in the region is projected to grow from 12% to 32% within 2012-2015.

|

|

|

(Source:LEDinside) |

Among the major countries, Singapore’s lighting market demand is highly saturated and its traditional lighting segment is shrinking. As a result, Singapore’s lighting market on the whole has seen a scale reduction in the recent years. This downward trend is likely to continue in 2015. However, the scale of the LED lighting segment is still growing. Besides Singapore, other countries in the region have experienced overall positive growths in their lighting markets during the same period. As a general decline set on these markets’ traditional lighting segment, LED lighting has become the main growth driver. Indonesia in particular leads in the general lighting’s market size as well as LED lighting’s. Based on LEDinside’s estimation, Indonesia’s general lighting market in 2014 would be valued at US$320 million.

Bullish Southeast Asia to become the main export destination for Chinese vendors

Southeast Asia has seen strong growths in the LED market in the past few years and the rate of replacement for traditional lighting has also increased. Since countries in the region have weak local manufacturing capabilities and rely on imports, the growing demands for LED lighting can also create huge import demands. The scale of imports from China will therefore multiply because of China’s advantages in manufacturing capabilities, geographical proximity, and product pricings. Wang expects positive policies and rising replacement demands will speed up the growths of Southeast Asia’s LED market penetration rate and LED imports. Furthermore, the region will eventually become the major export destination for Chinese LED vendors. Hence, vendors should accordingly direct their m

2015 Southeast Asian Lighting Market Report

Chapter One: Report Structure and Key Factors

-

Introduction to Chapters and Study Methods

-

Southeast Asia (SEA) Lighting Market Key Factors

-

Factor Conditions

-

Demand Conditions

-

Related and Supporting Industries

-

Government

-

Firm Strategy, Structure, and Rivalry

-

Chance

Chapter Two: SEA Market Macroeconomics

-

SEA Market Macroeconomics Overview

-

Basic Index

-

Average Electricity Price

-

Power Consumption

Chapter Three: Lighting Market Scale and Trend Analysis

-

Lighting Market Scale and Trend

-

Southeast Asian Lighting Market Scale and Trend

-

Thailand Lighting Market Scale and Trend

-

Singapore Lighting Market Scale and Trend

-

Malaysia Lighting Market Scale and Trend

-

Vietnam Lighting Market Scale and Trend

-

Indonesia Lighting Market Scale and Trend

-

Philippines Lighting Market Scale and Trend

-

Southeast Asia Countries – China Import Scale and Trend Analysis

-

Thailand – China Import Scale and Trend Analysis

-

Singapore– China Import Scale and Trend Analysis

-

Malaysia – China Import Scale and Trend Analysis

-

Vietnam – China Import Scale and Trend Analysis

-

Indonesia – China Import Scale and Trend Analysis

-

Philippines – China Import Scale and Trend Analysis

Chapter Four: Manufacturers Introduction and Strategies Analysis

-

Manufacturers Introduction and Strategies Analysis Overview

-

LED Lighting Industry Chain Structure Analysis

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

Major Positioning Strategies of Southeast Asia Lighting Manufacturers

-

Major Lighting Manufacturers Company Profile

-

Thailand

- Singapore

-

Malaysia

- Vietnam

- Indonesia

- Philippines

- Two Local Manufacturers Company Profile for Each Country

Chapter Five: Major LED Lighting Products Overview

- Major Lighting Manufacturers’ LED Bulb Pricing Strategy Analysis

- Thailand

- Singapore

- Malaysia

- Vietnam

- Indonesia

- Philippines

- LED Bulb Specification and Price

- Thailand

- Singapore

- Malaysia

- Vietnam

- Indonesia

- Philippines

- Major Lighting Manufacturers’ LED Tube Pricing Strategy Analysis

- Thailand

- Singapore

- Malaysia

- Vietnam

- Indonesia

- Philippines

- LED Tube Specification and Price

- Thailand

- Singapore

- Malaysia

- Vietnam

- Indonesia

- Philippines

- LED Street Light Specification and Price

Chapter Six: Lighting-Related Policies and Regulations

- Introduction

- Thailand

- Summaries

- Structure and Responsibility of Main Energy Agencies

- Main Regulations and Standards of Governments and Institutes

- Major LED Lighting-related Encouragement Policies and Standards

- Singapore

- Summaries

- Structure and Responsibility of Main Energy Agencies

- Main Regulations and Standards of Governments and Institutes

- Major LED Lighting-related Encouragement Policies and Standards

- Malaysia

- Summaries

- Structure and Responsibility of Main Energy Agencies

- Main Regulations and Standards of Governments and Institutes

- Major LED Lighting-related Encouragement Policies and Standards

- Vietnam

- Summaries

- Structure and Responsibility of Main Energy Agencies

- Main Regulations and Standards of Governments and Institutes

- Major LED Lighting-related Encouragement Policies and Standards

- Indonesia

- Summaries

- Structure and Responsibility of Main Energy Agencies

- Main Regulations and Standards of Governments and Institutes

- Major LED Lighting-related Encouragement Policies and Standards

- Philippines

- Summaries

- Structure and Responsibility of Main Energy Agencies

- Main Regulations and Standards of Governments and Institutes

- Major LED Lighting-related Encouragement Policies and Standards

Chapter Seven: ASEAN Developments and Impact on Lighting Industry

- Part 1: ASEAN Introduction and Development

- ASEAN Introduction and Development

- ASEAN-China Free Trade Area

- Global Economic Development Overview

- Analysis of ASEAN Free Trade Area & ASEAN Economic Community

- Part 2: ASEAN’s Impact on Lighting Industry

- ASEAN’s Impact on Lighting Industry

- FTA’s Impact on China LED Manufacturers – Tariff Preferential

- ASEAN Economic Community’s Impact on Chinese LED Manufacturers

- Chinese LED Manufacturers’ Advantages Analysis

- Chinese LED Manufacturers Recommended Strategies

Chapter Eight: Proposal on Entering into SEA Lighting Market

- Proposal on Entering into Southeast Asia Lighting Market

- Lighting Product Positioning Strategy in Southeast Asian Market

- Specification Strategy

- Pricing Strategy

- Strategic Analysis of Entering into Southeast Asian Lighting Market

- Product Requirements

- Product Positioning

- Channels Selection

- Government Relations

If you would like to know more details , please contact:

Joanne Wu +886-2-7702-6888 ext. 972

joannewu@trendforce.com

Subject

Related Articles

Recent Posts

- [News] U.S. to Double Tariffs on Chinese Solar Wafers and Polysilicon

- [News] China’s Chip Design Industry to Grow 12% in 2024, Though High Product Concentration Remains an Issue

- [News] Apple Reportedly Teams Up with Broadcom to Develop AI Chip Using TSMC’s N3P Process

- [News] U.S. Reportedly Set to Impose New AI Chip Restrictions on China Before Christmas

- [News] The Automotive Chip Market Is Emerging from the Cold

Recent Comments

Archives

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- May 2009

- April 2009

- March 2009

- November 2008

- October 2008

- September 2008

- August 2008

- March 2008

- January 2008

- December 2007

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- DataTrack-EN

- DataTrack-TW

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED Backlight

- LED Chip & Package

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Macroeconomics

- Market Today

- Market Trends

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Optical Semiconductors

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 市場日報

- 未分類

- 趨勢洞察