Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

LEDinside Says Global UV LED Market to Expand at a CAGR of 34% From 2015 to 2020 as Applications for Related Solutions Emerge

Taiwan’s major annual optoelectronics industry exhibition, Photonics Festival 2017, will be held in Nangang Exhibition Hall of Taipei World Trade Center from June 14 to 16. Some of the highlights in the LED section of this exhibition includes products for the automotive industry and applications related to ultraviolet (UV) LEDs. LEDinside, a division of TrendForce, projects that the scale of the global UV LED market will increase from US$288 million in 2017 to US$526 million in 2020. Furthermore, the CAGR of the UV LED market in the 2015~2020 period is currently estimated at 34%. These and other data can be found in LEDinside’s 2017 UV LED vs. UV LED Module Market Report.

Uses of invisible LEDs have expanded in scope, creating new opportunities for the whole LED industry. At the same time, an increasing number of UV LED products have become available for curing, printing, exposure and other major applications. Demand for UV LEDs are expected to keep climbing as most countries worldwide have endorsed energy saving policies and ratified the Minamata Convention on Mercury.

“The largest source of revenue for UV LED suppliers in 2016 was the sales of UV-A LEDs,” noted Joanne Wu, research manager of LEDinside. “Because UV-A LEDs are mainly used for curing, some UV LED suppliers have entered the curing module market to further increase their profitability in this business.”

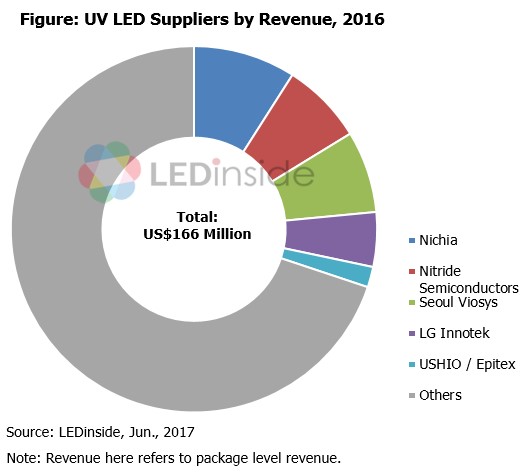

LED companies from South Korea and Japan were the dominant UV LED package suppliers by revenue in 2016. In the ranking, the top five suppliers in order were Nichia, Nitride Semiconductors, Seoul Viosys, LG Innotek and USHIO/Epitex. This year, South Korean LED companies are going to launch new series of UV-C LED products. UV-C LEDs, which have been technologically challenging to manufacture, will contribute greatly to South Korean suppliers’ revenues. Thus, there could be changes to this year’s revenue ranking.

Taiwanese LED companies are also eager to move away from the highly competitive blue LED market and into the UV LED market that has higher growth potential. Lextar, for instance, has released UV LEDs for curing and printing applications. The company is expected to accelerate product development and grow its client base this year. Likewise, LED chip maker High Power Lighting (HPL) and package supplier Epileds have formed a joint venture company Bioraytron that sells branded UV-C LED products. Bioraytron will also roll out new UV-C LED products in the second half of this year, and HPL anticipates that 30% of its annual revenue for 2017 will come from UV LEDs.

|

Looking at demand by applications, the largest segment of demand for UV-A LEDs comes from curing. Other major applications include printing and exposure. UV printing systems need LED modules that can produce a high level of irradiance, while UV exposure machines require LED modules that can achieve a high level collimated light. In addition, UV LEDs are also being deployed in some special curing applications that have recently emerged in the market.

As for UV-LEDs, recent technological advances in their manufacturing have allowed them to be deployed in more applications. LEDinside expects LED companies will roll out new UV-C products this year. Solutions for consumer appliances, air conditioners, air purifiers and still water purifiers will be first to arrive on the market and take off. UV-C LED products for flowing water purification are expected to enter the market later at a more opportune time.

- Why is UV LED Getting Popular?

- Wavelength and Applications

- UV LED Market Map

- Five Major UV Market Applications

- UV Market Applications

- 2016-2020 UV LED Market Scale

- 2016-2020 UV LED Market Scale By Applications

- 2016-2017 (F) Top 10 UV LED Revenue Ranking

- 2014-2016 UV LED Market Price Survey and Future Price Drop Forecast

- UV LED Market Opportunities and Challenges

- UV LED Market Value Chain Analysis

- 2018- 2020 UV LED Market Value Chain Analysis

- UV-A LED Package Types and Market Applications

- UV-A LED Products Enters High Price-Performance Ratio Era

- UV-A LED Product Specification and Application Requirement

- UV-A LED Player Progress

- UV Curing

- UV Technology Requirements in Curing Application Markets

- UV Curing Conditions

- UV Wavelength Distribution and Optical Design

- UV Irradiance vs. Radiant Energy Density

- UV Resin and Photoinitiator

- Free Radical Polymerization Curing

- Thickness and Energy

- Cooling System

- UV LED Penetration Rate Analysis- By Curing Application

- Curing Application Market Opportunity- By Region

- Curing Application Market Overview

- UV Curing Market Key Factors

- Curing Application Market Challenge- Optical Design

- Curing Application Market Challenge- Optical Design- Irradiance v.s. Irradiance Energy

- Curing Application Market Challenge- UV Adhesive- Customized Effect

- Curing Application Market Challenge- UV Adhesive- Oxygen Inhibition

- General Curing Market v.s. Exposure Machine Curing Market

- Traditional Printing and Digital Printing Analysis

- Printing Application Market Opportunity- By Technology

- 2010-2020 Printing Market Trend- By Application

- 2010-2020 Printing Market Trend- By Region

- UV LED Penetration Rate Analysis in Printing Market

- UV LED in Digital Printing Market- Possibilities and Challenges

- UV LED in Sheetfed Offset Market- Possibilities and Challenges

- 2016-2017 UV LED Module Market Size For Sheetfed Offset- Equipment Revenue and Major Companies' Revenue

- 2016-2017 UV LED Module Market Size For Sheetfed Offset

- UV LED Curing Process

- Printing Application Market Requirement

- Exposure Process

- UV LED in Exposure Machine Market

- Optical Design in Exposure Machine Market

- PCB / LCD Exposure Machine Market Demand and Major Players

- 2016-2020 UV LED Modules Market Size For PCB/ LCD Exposure

- Exposure Machine Market Requirement

- General Curing Market v.s. Exposure Machine Curing Market

- UV LED Nail Curing Application Market

- Nail Curing Manufacturer List

- Photocatalysis Combining with UV LED and TiO2 Coating

- Air Purifier Manufacturer List

- Manufacturer Development

- Product Features

- Future Plan

- Manufacturer Development

- Product Features

- Future Plan

- UV-C LED Product and System Requirements

- AlN / AlGaN on Sapphire’s Pros and Cons

- Bulk AlN / AlGaN’s Pros and Cons

- UV-C LED Technology Requirement

- UV-C LED Chip Technology

- UV-C Top Three Issue to Improve EQE

- UV-C LED Chip Technology Results

- UV LED Technology Evaluation

- UV-C LED Package Limitations and Technology Requirements

- UV-C LED Manufacturer Technology Trend

- UV-C Sterilization Principles

- Lethal Dose of UV-C on Various Bacteria and Viruses

- Sterilizing Effect of Irradiance for Microorganisms

- WHO Approved Irradiation Energy in Bacteria and Viruses

- Traditional UV-C Mercury Lamp and UV-C LED Tube

- UV-C LED Market Opportunity- Global Sterilization Market

- UV-C LED Market Opportunity

- Water: Drinking Water Purifier Manufacturer List

- Air: Air Purifier Manufacturer List

- UV-C Market Application and Requirement

- Water: UV Irradiation Device- Flow Style

- Water: Drinking Water Purifier Manufacturer List

- Food: Refrigerator Brand List

- Medical Treatment: Disinfection Market and Cancer Treatment

- Manufacturer Development

- Product Features

- Future Plan

+886-2-8978-6488 ext. 912

Subject

Related Articles

Recent Posts

- [News] U.S. to Double Tariffs on Chinese Solar Wafers and Polysilicon

- [News] China’s Chip Design Industry to Grow 12% in 2024, Though High Product Concentration Remains an Issue

- [News] Apple Reportedly Teams Up with Broadcom to Develop AI Chip Using TSMC’s N3P Process

- [News] U.S. Reportedly Set to Impose New AI Chip Restrictions on China Before Christmas

- [News] The Automotive Chip Market Is Emerging from the Cold

Recent Comments

Archives

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- May 2009

- April 2009

- March 2009

- November 2008

- October 2008

- September 2008

- August 2008

- March 2008

- January 2008

- December 2007

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- DataTrack-EN

- DataTrack-TW

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED Backlight

- LED Chip & Package

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Macroeconomics

- Market Today

- Market Trends

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Optical Semiconductors

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 市場日報

- 未分類

- 趨勢洞察