Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

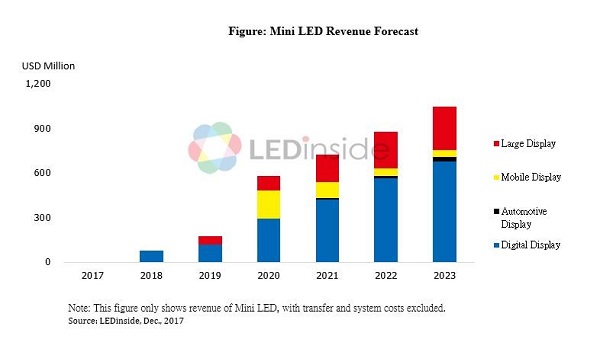

Mini LED sees potential in back lighting and digital display, with the revenue estimated to reach US$1 billion in 2023

LEDinside, a division of TrendForce, points out that LED manufacturers have turned to research and development of Mini LED, due to Micro LED’s technological bottlenecks which make it harder to realize commercialization in short term.

Companies can develop Mini LED using their current equipment, with only small changes of manufacturing process. Mini LED has the potential to be adopted for television, mobile phones, automotive display, digital display, etc., with revenue expected to reach US$1 billion in 2023. In particular, LED digital display and large-size TV will be the mainstream applications of Mini LED.

According to Simon Yang, Assistant Research Manager of LEDinside, with sizes of about 100-200μm, mini LED chips can be used for self-emitting displays and backlighting. Sony has released Micro LED display in 2016, which had rather high cost and technological barrier, so LED companies now turn to research on Mini LED, which has larger chip size, for realizing mass production in shorter time. Compared with traditional LED display, Mini LED display is more likely to have high dynamic range imaging and wider color gamut.

As for consumer electronics products, the cost of using Mini LED chips for a self-emitting display is too high, and the resolution may not meet the requirements of existing products. Therefore, the companies aim to use Mini LED as backlight to replace traditional backlighting in LCD panel. Mini LED backlighting can be used in TVs, mobile phones, automotive displays, etc. LEDinside estimates that Mini LED backlighting demos have chance to be released in 2018.

It is possible for high-end TV products to adopt Mini LED, which has advantages like high brightness and higher dynamic range imaging. In terms of applications in mobile phones, Mini LED-equipped products can realize high contrast and high brightness similar to OLED products. Together with local dimming, Mini LED is likely to compete with OLED in terms of performance and price.

Companies worldwide have been actively involved in the development of Mini LED products, including chip makers like Epistar, Lextar, San’an Optoelectronics, HC SemiTek, etc., packaging companies like Everlight, Advanced Optoelectronic Technology, Harvatek, Seoul Semiconductor, etc., IC designers like Macroblock, Raydium, etc., panel makers like AU Optronics, and Innolux Corporation, and digital display makers like Leyard, etc.

However, there are still challenges for the development of Mini LED. The high cost is a major concern since Mini LED product uses more chips, leading to higher costs in pick and place and bonding processes, as well as longer processing time and higher risks of low yield rate. In addition, Mini LED needs more optical distance, which adds to the difficulty in making the products thinner.

|

|

LEDinside |

Content |

Characteristics |

Format |

Frequency |

|

2018

Micro LED Next Generation Display Industry Member Report |

Overview and Outlook:

Micro / Mini LED Industry Overview and Outlook |

Overview and Outlook:

Micro / Mini LED Industry Overview and Outlook

Micro / Mini LED Market Development

Micro / Mini LED Technology Progress and Challenges

Micro / Mini LED Application Progress and Outlook

Micro LED Transfer Technology Analysis |

PDF |

Quarterly Update / Annual (January, April, July, October) |

|

Application: |

Micro LED in Projection Market Trend |

|||

|

Technology: |

Micro LED Driver Technology |

|||

|

Application: |

Micro / Mini LED in TV Market Trend |

If you would like to know more details, please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912

Subject

Related Articles

Recent Posts

- [News] Marvell Develops Custom HBM with Micron, Samsung, and SK hynix

- [News] U.S. to Double Tariffs on Chinese Solar Wafers and Polysilicon

- [News] China’s Chip Design Industry to Grow 12% in 2024, Though High Product Concentration Remains an Issue

- [News] Apple Reportedly Teams Up with Broadcom to Develop AI Chip Using TSMC’s N3P Process

- [News] U.S. Reportedly Set to Impose New AI Chip Restrictions on China Before Christmas

Recent Comments

Archives

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- May 2009

- April 2009

- March 2009

- November 2008

- October 2008

- September 2008

- August 2008

- March 2008

- January 2008

- December 2007

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- DataTrack-EN

- DataTrack-TW

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED Backlight

- LED Chip & Package

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Macroeconomics

- Market Today

- Market Trends

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Optical Semiconductors

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 市場日報

- 未分類

- 趨勢洞察