Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

News

- Home

- News

TrendForce 2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System

According to the latest report by the LEDinside research division of TrendForce, titled 2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System, Over 10 types of high-end smartphones are expected to use 3D sensing solutions and some of them will expand the use of 3D sensing in the front and rear cameras in 2020, which will further increase the VCSEL market value. According to TrendForce, the VCSEL market scale used for 3D sensing in mobile devices will be likely to grow by 30% in 2020.

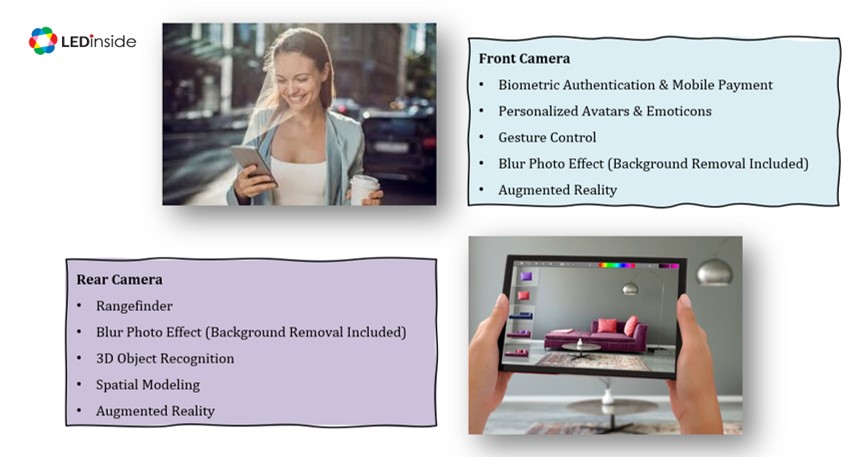

Smartphone brands will be engaging in a 'specs -contest' with their flagship devices, and 3D sensing will become an important feature in that race. 3D sensing used with front camera will provide the features include biometric authentication & mobile payment, personalized avatars & emoticons, gesture control, blur photo effect (background removal included) and augmented reality (AR). Since 2H19, 3D sensing has been equipped with rear camera to provide features like rangefinder, blur photo effect (background removal included), 3D object recognition, spatial modeling and augmented reality. 3D sensing combined with 5G transmission and AR function with gesture control to realize interactive augmented reality will welcome an indeed big opportunity.

“ Over 10 types of high-end smartphones are expected to use 3D sensing solutions and some of them will expand the use of 3D sensing in the front and rear cameras in 2020, which will further increase the VCSEL market value. According to TrendForce, the VCSEL market scale used for 3D sensing in mobile devices will be likely to grow by 30% in 2020.” says TrendForce Research Manager Joanne Wu.

The 3D sensing solutions currently used in the consumer market are structured light, time-of-flight (ToF) and active stereo vision.

1. Structured Light acquires the image through projected light patterns, and is able to determine depth with extreme precision, though it comes with a high cost and computational complexity. Moreover, APPLE holds the patent for the technology, forming a formidable patent barrier. The product trend of structured light VCSEL will move toward for providing larger field of view, more uniform image, small package size, so the screen-to-body ratio further improves.

2. Time of Flight does not enjoy the precision and depth that structured light does, but its fast reaction speeds and detection range make up for it. TOF cameras may be divided into front-facing and world-facing versions, with front-facing ToF costing more and world -facing cameras using the higher power VCSELs. Currently, indirect ToF sensing solution is widely used. Direct ToF is going to become the trend in the future, the major advantage is to save energy. Time of Flight technology will be used in APPLE, Samsung Electronics, Huawei, SONY, etc.

3. Active Stereo Vision calculates depth information by using two or more than two cameras to collect images simultaneously and comparing the differences between images got at the same time. Google Pixel 4 adopts active stereo vision, which can be seen that Google overcomes the precision problem of hardware module with higher software calibration ability compared to other competitors in the industry. Likewise, active stereo vision uses dot projector and flood illuminator, but the technical complexity and cost of VCSEL are greatly reduced compared to structured light technology.

As APPLE owns comprehensive structured light patent of hardware and software to provide the highest safety. Regarding facial recognition, the effect of Front Facing ToF is not as good as that of Structured Light. Thus, some mobile vendors are looking for the best solutions in the market.

Major VCSEL-related companies currently include Lumentum, Finisar, OSRAM's Vixar, ams, Lite-on Technology, WIN Semiconductors Corp., Advanced Wireless Semiconductor Company (AWSC), Visual Photonics Epitaxy Co., Ltd. (VPEC), etc. But the new supplier is likely to appear as function applications increase from front camera to rear camera.

According to the latest report by the LEDinside research division of TrendForce, titled "2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System," in 2020, market attention will focus on infrared sensing applications including mobile devices 3D sensing, LiDAR, driver monitoring system, optical communication, SWIR and broadband IR market potential, 1D ToF and proximity sensor and more.

LEDinside concentrated on major infrared sensing application markets mentioned above, discussed and analyzed market size, opportunity and challenge, product specification and supply chain from the prospective of terminal application requirements, with an aim to provide a more comprehensive understanding of IR sensing application markets for readers.

2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System

Release Date: 01 January 2020

Language: Traditional Chinese / English

Page: 153

Chapter I. Infrared Market Scale and Application Trend- IR LED, VCSEL and LiDAR Laser

Scope of the Report- Infrared Sensing Market Applications

Infrared Sensing Market Applications- Power and Sensing Distance

Scope of the Report- 3D Sensing Market Applications

2019-2020 3D Sensing Module Market Scale- Mobile Devices 3D Sensing, Automotive LiDAR and Industrial LiDAR

1.1 Infrared LED Market Scale and Application Trend

2019-2020 IR LED Market Scale

2019-2020 IR LED Market Scale- Segment Market Analysis

IR LED Product Performance and Price Analysis

1.2 VCSEL vs. EEL Market Scale and Application Trend

2019-2020 VCSEL Market Scale

2019-2020 EEL Market Scale- LiDAR Laser

VCSEL Manufacturing and Product Strengths

>1,000nm VCSEL Manufacturing Challenge Analysis

EEL Manufacturing and Product Strengths

VCSEL Players M&A and Investment for 3D Sensing Market

VCSEL vs. EEL Player List

Global 30 Players Production Capability and Target Market Analysis

2020 VCSEL / EEL Player Target Market Analysis

2018-2020 VCSEL Product Performance and Price Analysis

Chapter II. Mobile Devices 3D Sensing Market Trend

Major Biometric Method Pros and Cons

2020 Mobile Sensing Market Penetration Analysis

2.1 Mobile Devices 3D Sensing

3D Sensing Technology Overview

3D Sensing Technology Comprehensive Analysis on Cost and Computation Complexity

3D Sensing Technology- Strategic Alliance and Player Status

Mobile 3D Sensing Function- Front Camera vs. Rear Camera

Structured Lighting Depth Camera Cost and Supply Chain

Structured Lighting Depth Camera Structure and Potential Supply Chain

Time of Flight Depth Camera Cost- Front Facing

Time of Flight Depth Camera Cost- World Facing

Time of Flight Depth Camera Structure and Potential Supply Chain

Active Stereo Vision Depth Camera Cost

Active Stereo Vision Depth Camera Structure and Potential Supply Chain

VCSEL Chip and Package Technology Analysis

2020 Structured Light VCSEL Technology Evolution

2020 Direct and Indirect ToF VCSEL Technology Evolution

VCSEL Burn in and Test Requirements in All Phases

2019-2020 Mobile 3D Sensing Value Chain Analysis

2019-2020 Mobile 3D Player Competitive Landscape Analysis

2019-2020 Mobile and Mobile Devices 3D Sensing Timeline and Landscape Analysis

2019-2020 Mobile Devices 3D Sensing Module Market Scale

2019-2020 Mobile Devices 3D Sensing VCSEL Market Value and Volume

2019-2020 Mobile Devices 3D Sensing VCSEL Market Value and Volume- By 3D Sensing Solutions

2.2 Fingerprint Recognition vs. 2.5D Facial Recognition

2019 Optical and Ultrasonic FOD Penetration Rate and Cost Analysis

Optical and Ultrasonic FOD Technology Analysis

2.5D Face ID Principles and Product Advantages

2.5D Face ID Market Demand and IR LED Product Requirements

Chapter III. LiDAR Market Trend

LiDAR Product Definition

Global LiDAR Player List- By Region

Scanning LiDAR Execute Process

Flash LiDAR Execute Process

Scanning LiDAR vs. Flash LiDAR Technology Analysis

Scanning LiDAR vs. Flash LiDAR Analysis

Scanning LiDAR vs. Flash LiDAR Player Analysis

3.1 Automotive LiDAR Market

2020-2024 Automotive LiDAR Market Value

Autonomous Car Market- Merge, Investment, Strategic Alliance Analysis

Autonomous Vehicle vs. ADAS

Automotive Sensing Analysis- LiDAR, Radar and Camera

2020-2024 Passenger Car Market Trend

Passenger Car- Autonomous Vehicle L3 vs. L5 LiDAR and Senor Requirement

2020-2024 Autonomous Bus Market Trend

Autonomous Bus Market Landscape Analysis

Autonomous Bus- Autonomous Vehicle L4 LiDAR and Senor Requirement

Automotive Grade LiDAR Product Overview

Automotive LiDAR Market Restriction Factors

Pros and Cons of the Integration of LiDAR and Headlamp

3.2 Industrial LiDAR Market

AGV and AMR Product Advantages Analysis

AGV vs. AMR Market Landscape Analysis

AGV vs. AMR LiDAR and LiDAR Laser Product Requirement

3.3 LiDAR Laser Market Requirements and Key Players

LiDAR Three Basic Components and Market Requirements

LiDAR End Product Requirements and Light Source Analysis

LiDAR Laser Product Portfolio and Player Analysis

905nm vs. 1,550nm LiDAR Laser Advantages and Applications

LiDAR Photodetector Product Trend Analysis

2020-2024 LiDAR Laser Market Value

LiDAR Laser and Photodetector Player List

Chapter IV. Driver Monitoring System Market Trend

Driver Monitoring System

Truth and Data of Car Accidents

Will Driver Monitoring System Become Vehicle Safety Standard?

Driver Monitoring System Product Design- OE and AM

IR LED vs. VCSEL Product Requirement

Driver Monitoring System Market Landscape Analysis

Chapter V. SWIR LED and Broadband IR LED Market Trend

Short Wave InfraRed (SWIR) Product Definition and Market Strength

5.1 SWIR LED Market Trend

SWIR Application Market Overview

SWIR Application Markets – By Wavelength

SWIR Application Market Opportunities

SWIR Application Cases Analysis

SWIR LED Player and Product Analysis

3-5μm SWIR Market Opportunities and Potential Suppliers

SWIR IR LED Market Opportunities and Potential Customer List

5.2 Broadband Infrared LED Market Trend

Broadband Infrared LEDs Application Market Overview

Broadband Infrared LED Product Definition and Market Advantages

Broadband Infrared LED Player and Product Analysis

Chapter VI. 1D Time of Flight vs. Proximity Sensor

Mobile vs. Wearable Device Sensing Market Trend

2019-2020 Mobile vs. TWS Shipment Forecast

2019-2020 Mobile Devices- Proximity Sensor vs. 1D ToF Market Trend

2019-2020 TWS and Smart Home Appliance Sensing Market

1D ToF vs. Proximity Sensor Market Landscape Analysis

Chapter VII. Optical Communication Market Trend

Optical Communication Market Definition

2020 Key Factors of Optical Communication Market Growth

Major Optical Communication Player and Product Plan

2020-2022 Data Center Ethernet Port Market Scale

2020-2022 Optical Communication Trend in DataCom Market

100Gbps vs. 400Gbps Product Trend

VCSEL vs. Silicon Photonics vs. EEL Product Analysis

2019-2023 Optical Communication VCSEL Market Trend

Optical Communication Market Landscape Analysis

|

For further information about the report, please contact:

|

|

|

Global Contact: |

|

|

Grace Li +886-2-8978-6488 ext 916 E-mail :Graceli@trendforce.com |

|

|

Taipei: |

ShenZhen: |

|

Eric Chang Tel : +886-2-8978-6488 ext 822 E-mail : Eric.chang@trendforce.com |

Perry Wang Tel : +86-755-82838931 ext.6800 E-mail : Perrywang@trendforce.cn |

|

|

|

|

For further information about the advertising, please contact:

|

|

|

Global Contact: |

Taipei: |

|

Melissa Ye Tel : +886-2-8978-6488 ext 823 E-mail : Melissaye@trendforce.com |

Christina Tsao Tel : +886-2-8978-6488 ext 824 E-mail : Christinatsao@trendforce.com |

Subject

Related Articles

Recent Posts

- [News] U.S. to Double Tariffs on Chinese Solar Wafers and Polysilicon

- [News] China’s Chip Design Industry to Grow 12% in 2024, Though High Product Concentration Remains an Issue

- [News] Apple Reportedly Teams Up with Broadcom to Develop AI Chip Using TSMC’s N3P Process

- [News] U.S. Reportedly Set to Impose New AI Chip Restrictions on China Before Christmas

- [News] The Automotive Chip Market Is Emerging from the Cold

Recent Comments

Archives

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- May 2009

- April 2009

- March 2009

- November 2008

- October 2008

- September 2008

- August 2008

- March 2008

- January 2008

- December 2007

Categories

- 5G Technologies

- AR / VR

- Artificial Intelligence

- Automotive Technologies

- Broadband & Home Network

- Cloud / Edge Computing

- Consumer Electronics

- DataTrack-EN

- DataTrack-TW

- Display

- Display Supply Chain

- Display Technologies

- DRAM

- Emerging Technologies

- Energy

- IC Design

- IC Manufacturing, Package&Test

- Industry 4.0

- IoT

- IR LED / VCSEL / LiDAR Laser

- LCD

- LED Backlight

- LED Chip & Package

- LED Demand / Supply Data Base

- LED Display

- LED Lighting

- Lithium Battery and Energy Storage

- Macroeconomics

- Market Today

- Market Trends

- Micro LED / Mini LED

- Monitors / AIO

- NAND Flash

- Notebook Computers

- OLED

- Optical Semiconductors

- Others

- Panel Industry

- Semiconductors

- server

- Smartphones

- Solar PV

- Tablets

- Telecommunications

- TVs

- Upstream Components

- Wafer Foundries

- Wearable Devices

- 市場日報

- 未分類

- 趨勢洞察