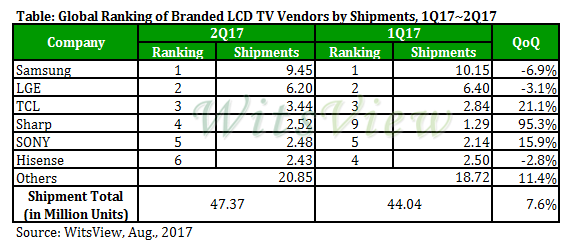

Global shipments of LCD TV sets totaled 47.37 million units for the second quarter of 2017, according to WitsView, a division of TrendForce. While this shipment figure represents an increase of 7.6% from the prior quarter, it also amounts to a year-on-year decrease of 5.2%. The Chinese TV market remained sluggish, while sales in North America were affected by channel distributors’ price hikes.

Samsung, LG Electronics (LGE) and TCL retained their respective first, second and third place in the second-quarter shipment ranking. Sharp, however, made the biggest gain as it nearly doubled its shipments for the period and leaped from ninth to fourth place worldwide. Sharp’s success has been attributed to its parent company Foxconn’s ongoing efforts to vertically integrate the supply chain.

WitsView points out TV panel prices started to flatten during this May and June period after riding on an uptrend for more than a year. Furthermore, the overall production capacity for the panel industry is expected to increase steadily through the second half of 2017. For branded TV vendors, they are not satisfy with the current pace of price decline in the panel market and are confident that they can get prices come down by a larger margin. This situation is unlike in the previous years, when branded TV vendors were under pressure to stock up panels for the year-end busy season in the third quarter. This year, TV brands with their orders will try to turn the table on panel suppliers during their third-quarter procurement talks and force panel prices to go down. On the whole, WitsView’s latest outlook on the TV market for this year’s second half finds lots of uncertainties.

Samsung has marked down its annual shipment target while LGE gets a big boost from its OLED TVs

Samsung was still the shipment leader for the second quarter despite registering a drop of 6.9% from the prior three-month period. Samsung attempts to capture more of the high-end market segment this year with its QLED TVs, but consumers’ interest in these models has been lukewarm. On account of the lackluster performance in the year’s first half and excess inventory for its premium TV sets, Samsung has lowered its annual shipment target to 44 million units. The sum of the vendor’s in-house target and its orders to TV ODMs is projected to be 46 million units shipped for the entire 2017.

Just as Samsung struggles to hold on its share of the high-end market, LGE is finding success in this segment by selling OLED TVs. Even though LGE was still runner up in the second-quarter ranking and posted a drop of 3.1% compared with the first quarter, its OLED TV strategy has narrowed its shipment gap with Samsung.

Also benefitting from targeting the high-end market in the recent years, SONY grew its TV shipments 15.9% in the second quarter compared with the first-quarter result. WitsView estimates that LGE and SONY will either keep their annual shipments on par with their last year’s figures, or they will post small annual increases.

Sharp nearly doubled its shipments this second quarter because of Foxconn’s effective integration of upstream and downstream resources

TCL was third in the second-quarter ranking. With the in-house panel supply provided by its subsidiary CSOT, the Chinese brand increased its TV sales in the overseas markets and expanded its total shipments for the period by 21.1% versus the first quarter. By contrast, Hisense posted another sequential drop of 2.8% for its second-quarter shipments as it found itself lacking a reliable partner in the panel market. Hisense also fell two spots in the global ranking from the fourth place to the sixth.

Sharp’s second-quarter TV shipments was almost twice as large compared with its first-quarter figure, and the brand soared from the ninth place to the fourth in the global ranking. Sharp also posted a massive 70% year-on-year increase for the first half of 2017, totaling 3.8 million units. This turnaround indicates that Foxconn’s vertical integration of its panel, TV assembly and brand business operations has strengthened Sharp’s position considerably.

Whether Sharp will achieve its ambitious annual target of 10 million units will depend on its performance in the Chinese market during this year’s second half. Currently, Chinese channel distributors are seeing rising inventory for Sharp TV sets. China’s domestic brands are also gearing up for a massive sales drive during these last six months. Sharp needs to find ways to sustain its shipment growth in China in order reach its 2017 target.

Global TV shipments fell significantly in the year’s first half; panel prices will be the key factor that drives the shipments in the second half

Chinese TV brands started to change their approach and became more aggressive in the mid-June online sales period as they find that their pricing is linked to their lackluster sales results. Before that, they have not lowered prices considerably to stimulate demand during the busy periods of the Chinese New Year and the Chinese Labor Day. For the second half of 2017, Chinese TV brands will take advantage of the increase in the panel production capacity to negotiate down panel prices. This way, they can lower the costs of their TV sets and use promotional pricing to drive shipments, especially during the critical year-end peak season.

Still, it is unlikely that efforts from branded TV vendors in the year’s second half will fully offset the shipment decline in the first half. WitsView’s latest annual TV shipment projection for 2017 puts the total around 214 million units, a decrease of 2.3% from the earlier forecast of 219 million units.

Subject

Related Articles

Related Reports