Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Force

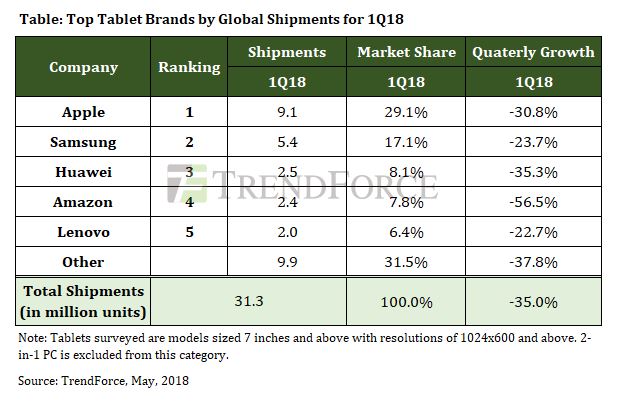

Market research firm TrendForce reports that the global tablet shipments for 1Q18 recorded only 31.29 million units, a steep quarterly decline of 35.0% due to the traditional off season. When it comes to the second quarter, the tablet shipments are expected to grow by 11.4% quarterly driven by the education market. The year-on-year shipments growth may return to a positive figure of 1.5% in 2Q18.

“Tablets are no longer the focus of market, but have become low pricing products, helping vendors increase market shares,” says Kou-Han Tseng, TrendForce notebook analyst, “but the education market has gained much attention recently”. Apple in 1Q18 launched the 9.7-inch tablets, priced at $329, and offered an education discount of $299. Chrome OS tablets for education were released in early 2Q18 while Microsoft tablet products are also expected to come out at the end of 2Q18. After the entry of this new player, all three major OS system developers will present themselves in the market, bringing new growth momentum to tablet shipments in 2Q18.

Chinese brands showed stable shipping performance in 1Q18, while Huawei is gaining market share steadily

In 1Q18, Apple took the first place with 9.11 million units of iPad devices shipped, bringing its market share up to 29.1%, 1.2 percentage points up from 1Q17. The shipments of iPads are expected to increase by 12% quarterly in 2Q18 driven by the release of new 9.7-inch iPads.

Samsung, ranking the second, shipped 5.37 million units of tablet in 1Q18, a quarterly decline of 23.7%. Although Samsung actively develops the commercial segment of tablet market and high-end AMOLED tablets, it remains difficult for the company to boost the sales of premium products. As a result, Samsung's market share fell to 17.1% in the first quarter, down from 19.1% in 1Q17.

Huawei had a remarkable performance with 2.53 million units of tablets shipped in 1Q18, ranking the third. In order to enhance the sales of its consumer products, Huawei has cooperated with telecom companies to promote its premium models. It has also targeted emerging markets with its entry-level products, boosting its market share to 8.1%.

Amazon shipped 2.45 million tablets in the first quarter, a quarterly decline of 56.5%, ranking the fourth. This year, its Kindle Fire products will develop towards a larger size. In addition to shipping standard 7-inch models, the 8-inch and even 10.1-inch models will be the main driving force for shipment growth this year.

Lenovo shipped 2.01 million units in the first quarter, a quarterly 22.7% decline, ranking the fifth. Lenovo has been aggressively expanding in the Europe and the emerging markets, thus recording 2 million shipments even in the off-season. Its market share came to 6.4%, roughly the same as in 1Q17.

Subject

Related Articles

Related Reports