According to WitsView, a division of TrendForce, its latest TV research report shows that the threat of looming China-US trade war tariff covered the year 2019. Besides, consumers' habits of using TVs were changed, so demand was indirectly reduced. Fortunately, brands' promotional campaigns during Black Friday and November 11 were helped by massive fall of TV panel prices in 4Q19. Thus, the TV set shipment only slightly declined by 0.8% YoY in 2019, reaching 217.8 million units.

In early 2020, COVID-19 outbreak began to spread. All levels of governments in China refrained people from moving freely, in order to suppress the spread of outbreak. TV brands that mostly center on China's domestic market suffered heavy losses of sales. In March, China's epidemic situation is steadily being contained. By contrast, the COVID-19 pandemic rapidly soars in Europe and America continents. In addition, many countries' stock markets crashed, and financial markets were severely hurt. These factors significantly damaged consumers' confidence of future economy outlook. In particular, consumption toward non-essential products became more conservative.

In addition, UEFA EURO 2020 and 2020 Tokyo Olympic Games that were supposed to be held in 2020 were postponed to 2021 because of the escalating COVID-19 pandemic. Therefore, TrendForce decreased TV set shipment prediction quantity to 205.2 million units in 2020, down by 5.8% YoY. When the pandemic can't be effectively contained in the future, TrendForce might move down the annual shipment prediction again.

In 1Q20, the shipment is reduced by 8.6% from the pre-COVID-19 forecast; that of 2Q20 is moved down by 7.3%

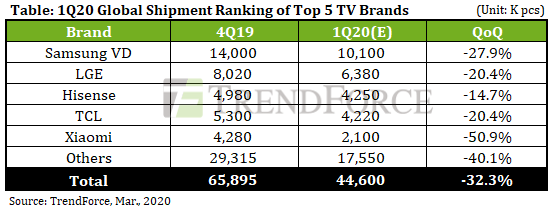

In 1Q20, the TV industry is currently pressed both on the production side and demand side. TrendForce reduces its prediction of global shipment for 1Q20 to 44.6 million units, down by 8.6% from the pre-COVID-19 prediction (48.8 million units).

Particularly, China's sales portion in Xiaomi and Skyworth both exceed 70%. In 1Q20, Xiaomi's shipment quantity fell from pre-COVID-19 prediction by 25.9%, and that of Skyworth dropped by 21%. These 2 brands were hit the hardest. Amid international brands, they suffered slightly in 1Q20. In contrast, as the pandemic ravages globally, all brands' shipments will eventually unavoidably decline. TrendForce modifies its shipment prediction for 2Q20 from pre-COVID-19 prediction's 47.6 million units to 44.1 million units, down by 7.3%. For the near future, brands whose Europe's shipment portion surpasses 30%, such as Samsung VD, LGE, Sony and Philips, might be next victims of the pandemic.

End-market demand quickly falls, and panel price rise hike might be halted in 2Q20

TV panel prices rebounded in 1Q20 mainly because of 3 reasons below. First, Korean panel makers began to shrink their capacities from the end of 2019. Next, majority of panel size segments' prices dropped below their cash costs. Third, after Chinese New Year Holidays, factories across China postponed their work resumption schedules. Therefore, panel supply decreased. In 1Q20, the panel prices of 32" and 55" both grew more than 10% QoQ from 4Q19.

By contrast, as the COVID-19 pandemic spreads worldwide in March, on the demand side, brands will definitely reduce their panel procurement quantity in 2Q20. TrendForce, as a result, predicts that the reduction scale might reach 8-10%. On the supply side, panel supply steadily recovers to pre-COVID-19 levels. When demand might fall and supply might increase, panel prices' negotiation power will shift from sellers to buyers in April. In other words, the panel price hike will stop.

Subject

Related Articles

Related Reports