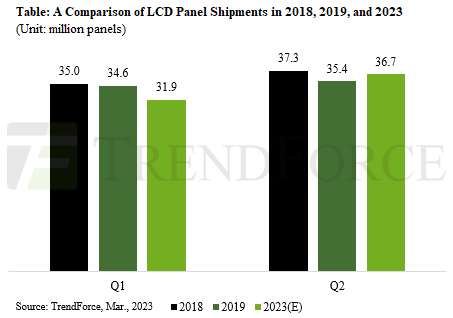

TrendForce estimates that approximately 31.9 million LCD monitor panels were shipped in 1Q23, indicating a 2.6% QoQ and 33.4% YoY decline. This drop in shipments can be attributed to several factors, including fewer working days, weak demand in the end-market, and inventory adjustments. However, since March, brands have been more optimistic about product demand for 2Q23, which has driven up order visibility for LCD monitor panels. TrendForce projects that shipments will reach 36.7 million units in 2Q23—a 15.1% QoQ growth. Comparing this number to pre-pandemic figures, with 37.3 million shipments in 2Q18 and 35.4 million shipments in 2Q19, we can see that the figures are almost on par.

TrendForce explains that there are three main factors contributing to the increase in shipment levels in 2Q23: Firstly, Internet cafés in China are seeing a rising surge of customers after COVID restrictions were lifted in December of last year. To help attract these customers, cafés are working to upgrade their current gaming LCD monitors to higher-end models. However, the current supply of ICs (DDICs and T-cons) used in the production of these high-end gaming monitors may be insufficient in fulfilling this sudden uptick in demand.

Secondly, panel makers have observed that demand from international logistics channels is on the rise as channels are working to replenish their inventories after destocking for several quarters. Lastly, while monitor brands were forced to contend with a frozen consumer market in 2022, they are now stocking up in preparation for China’s 618 Shopping Day, which is expected to revitalize sales as China relaxes its COVID restrictions in an effort to restore its economy. Additionally, brands are being enticed by low panel prices to stock up.

TrendForce believes that demand recovery in 2Q23 will primarily be boosted by consumers, while commercial demand continues to remain sluggish; we can expect in 2H23 for brands to continue maintaining a conservative outlook on commercial demand. Meanwhile, as we move into the traditionally peak final half of the year, judging on how successful sales are during China’s 618 Shopping Day and in European markets, there may be further opportunities for consumer markets to boost demand.

For more information on reports and market data from TrendForce’s Department of Display Research, please click here, or email Ms. Grace Li from the Sales Department at graceli@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://insider.trendforce.com/

Subject

Related Articles

Related Reports