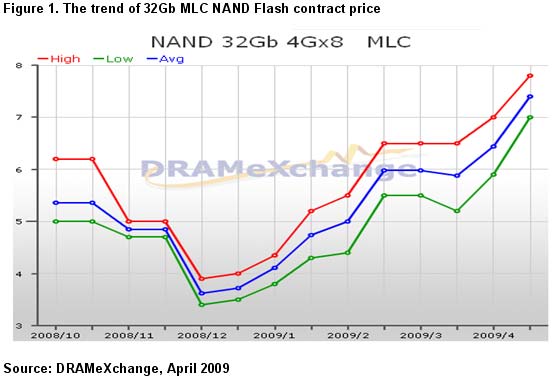

April,28th,2009,Taipei---In 2H April, the mainstream MLC NAND Flash contract price went up about 8% to 18% reflecting the inventory replenishment demand of system clients and China mobile phone market and the continuing supply controlling of NAND Flash vendors.DRAMeXchange says.

The NAND Flash downstream system clients mostly replenish their inventory quarterly and therefore require higher procurement quantity than the memory card clients. After the decreasing of downstream system client inventory level in Q209, the inventory replenishment for the beginning of Q309 new products has started.

DRAMeXchange states,since the NAND Flash vendors has set NAND Flash downstream system clients and their coordinating partners with higher supplying priority, the total supply to UFD and memory card clients has decreased. While facing low inventory level and worrying about insufficient sources for buying, the memory card makers are now more agreeing to the contract price raise.

Meanwhile, the China Home Appliance Subsidy Policy, 3G upgrade, Pirate phones, and the pre May 1st labor day inventory replenishment all making the effects of China rush orders after lunar new year and inventory replenishment sustaining. On the other hand, after the price came back close to their wafer cost, the NAND Flash vendors still keep controlling their outputs and tend not to increase Q209 wafer outputs in order to maintain the stable market price and improve their profitability. These are two additional reasons that supported the April price keep surging.

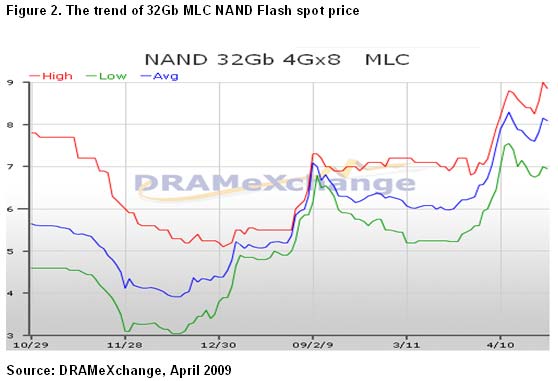

Analyzing the spot price trend of the mainstream chip 32 Gb MLC, after the NAND Flash price has rallied quickly since Q109, the recent uptrend has started consolidating. This is mainly reflecting the concerns of whether the rush orders of system clients will sustain after May and how the May 1st holidays sales will perform.

Currently the electronics end product vendors are expecting the short term orders to sustain until June and the NAND Flash vendors tend to slowly increase the May contract price. If the June demand is lower than expected, they will try to stabilize the price in order to improve their profitability and give time and space to the memory card clients for them to adjust the memory card prices. Therefore the 1H May contract price of mainstream NAND Flash MLC is expected to raise another 5% or more. According to DRAMeXchange.

Subject

Related Articles

Related Reports