According to DRAMeXchange, with the aggressive DDR3 migration in PC-OEMs and enhancing demand, DDR3 contract price has sharply rose 36% in line with the 24% increase of spot price. DDR2 contract price also hiked along with the DDR3 contract price that 3Q09 DDR2 contract price has rose 31% due to the tight supply in DDR2 and DDR2 inventory replenishment from some PC-OEMs. DDR2 spot price also rose 30% in 3Q09 as well.

Benefited from the 36% rising DDR3 contract price, 24% rising DDR3 spot price and 30% rise DDR2 price, DRAM vendors record the average 15%~55% quarterly revenue growth. Samsung and Powerchip achieved the 50% revenue growth target, which is far better than the market average.

According to DRAMeXchange, 3Q09 DRAM revenue increase 40.7% to US$5,719M. Samsung continue its unchallenged leadership in the DRAM industry recorded in US$1,781M DRAM revenue in 3Q09 with 51% QoQ while market share has climbed 2.1% to 31.1% given the upward pricing trend in contract price, 50nm technology migration and raise DDR3 portion. 3Q09 Hynix DRAM sales rose 42.1% to US$ 1,318M given the 26% average price growth, 12% quarterly bit growth. Currently Hynix ranks as 2nd place and its market share has been increased 0.2% to 23%.

Elpida recorded 3Q revenue in US$1,025M with 37.6% QoQ benefited from 19% upward DRAM quarterly average price and 13% bit growth. Elpida has strengthened its 3rd market leading position given the larger gap between Elpida and Micron in 2Q09. For the different accounting period (3Q for Micron is Jun., Jul. and Aug.) it applied for the accounting periods, contract price merely rose 8% compared with last periods (Mar., Apr. and May). Benefited from the price and 19% QoQ shipment enhancement in this quarter, Micron recorded US$705 quarterly revenue with 28%QoQ. Micron would grab 4th place in the ranking while market share has declined to 12.3% in 3Q09 from 13.5% in 2Q09 given the below industry average revenue growth.

As for Taiwanese vendors, Nanya ranks 5th post along with US$334M DRAM revenue and 45.3% QoQ given the upward pricing trend in average quarterly price(35%) and 5% quarterly shipment growth. Benefited from the 30% boosting DDR2 spot price and 82% utilization rate from 41%, PSC shows the amazing 52.9% revenue growth in 3Q09 and market share has slightly increased 0.3%. Winbond announced its 3Q09 DRAM revenue in US$146M with 43.7%QoQ. The market share has climbed to 2.6%. ProMOS also demonstrates the 15.3%QoQ revenue pattern with the upward pricing trend as well.

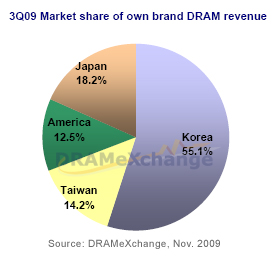

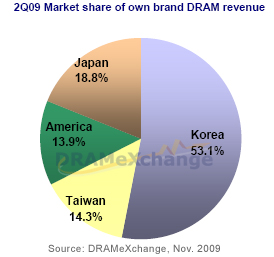

The Korean vendor’s share has achieved to 55.1% in 3Q09 and their leader position remained unchallenged while shares from Taiwanese, Japanese and American vendors has various decline respectively. Market share of Taiwanese vendors has slightly decline 0.1% to 14.2% while market share of Japanese vendors shrunk 0.6% to 18.2%. Given the below-average growth that American vendor has, its market share has been declined 1.4% to 12.5%.

Figure 1:

Note:

Figure-1: For Samsung 3Q09 DRAM revenue , we approximately derived the resulted by deducting LSI revenue from semiconductor based on the assumption that DRAM revenue accounts for 58% in memory sectors and 3Q09 average exchange rate is US$1 against KRW$1,237.5. We apply this estimation to other vendors by indicating 77% for Hynix total revenue, 54% for Micron. 85% for PSC, 80% for ProMOS, 95 for Nanya and 84% for Winbond under the following exchange rate: US$1 against NT$32.8, US$1 against JPY$93.5.

Subject

Related Articles

Related Reports