Fabless semiconductor giant Broadcom Limited (shortened here as Broadcom) announced on November 6 that the company is offering US$130 billion to acquire its rival Qualcomm. Qualcomm’s official response is that the company board is currently reviewing the proposal. This deal, if approved by Qualcomm’s board, represents another milestone for M&As in the global semiconductor sector as its value sets a new record high for the industry. Once completed, TrendForce expects the deal will expand Broadcom’s presence in the automotive electronics market. Furthermore, the joining of Broadcom and Qualcomm will impact the global foundry market and threaten the competitiveness of China's and Taiwan's IC industries in the future.

The most likely motive behind Broadcom’s bid for Qualcomm is the target’s rich product portfolio for the automotive application. “Already a global leader in wireless communication solutions, Qualcomm is currently proceeding with the acquisition of NXP,” said CY Yao, TrendForce’s associate analyst covering the semiconductor sector. “Once Qualcomm incorporates NXP, the company will become a major automotive chip supplier with the most comprehensive offerings.”

As a major supplier of automotive Ethernet chips, Broadcom has also considered that the automotive electronics market will be growing at a steady pace in the future. Thus, Broadcom stands to gain significantly in this application area by taking over Qualcomm with the NXP deal intact.

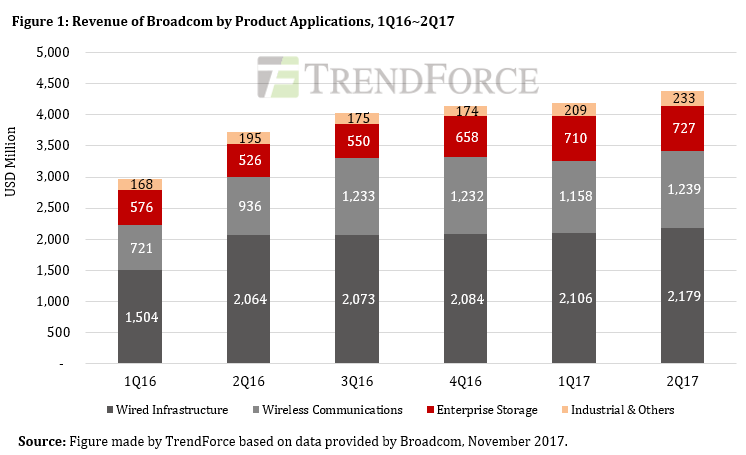

Yao further pointed out that NXP, in addition to being the largest supplier of automotive semiconductor components before its takeover, also has a wide-ranging product lines for wired infrastructure. Therefore, Qualcomm with NXP under its wings is highly complementary to Broadcom, which also has wired infrastructure making up a critical part of its revenue stream according to financial reports and deal-making records. Also, five of NXP’s top 20 customers belong to the wired infrastructure segment.

[1] The new fabless behemoth will have greater bargaining power with foundries and providers of IC testing and packaging services

If Broadcom’s is successful in acquiring Qualcomm, the global semiconductor sector will be affected in several respects. First, the new entity that would emerge from this deal will have a much stronger position when negotiating prices with foundries and providers of IC testing and packaging services. Once the deal goes through, the rest of the semiconductor sector will be looking closely at the respective relationships that the newly reorganized Broadcom has with TSMC and ASE Group.

[2] Taiwan’s IC design sector will face harder competition

Led by MediaTek, Taiwan’s IC design sector has always performed well in areas related to consumer electronics. However, many of these end product markets have now matured. At the same time, the general growth momentum in the smartphone market is also gradually slowing down. Other applications such as industrial IC components, automotive electronics and wired infrastructure are fields where Taiwan's design houses have not been particularly active. As IC companies across world initiate M&As as a way to quickly capture different vertical markets, Taiwan's design houses have been left behind and in a weaker position. The consolidated foreign IC companies, for example, have the resources to corner particular application markets and raise higher barriers against new market entrants.

[3] For China's IC design houses, the union of Broadcom and Qualcomm will be another major challenge that requires the support of government to overcome

China’s IC industry has been very determined to quickly catch up to foreign competitors in recent years, and its influence across different segments of the global semiconductor market is also growing steadily. Domestic companies such as NavInfo and Rockchip have recently entered the automotive electronics market with chips used in advanced drive assistance systems. Their efforts again reflect the incredible ambitiousness of the China's IC suppliers. However, the possible union between Broadcom and Qualcomm will pose a serious threat to new Chinese entrants to the automotive market. If this deal has materialized, an important follow-up development will be whether the Chinese government is going take actions to defend its domestic automotive chip suppliers.

[4] Successful conclusion of this deal will change the competitive landscape of the semiconductor chip market

NXP still has several wafer fabs and plants for IC testing and packaging even after the company has agreed to be acquired by Qualcomm. There is a likelihood that these facilities will not be sold off when Broadcom in turn takes over Qualcomm. Under such scenario, Broadcom will become one of the largest semiconductor chip manufacturers, following Intel and Samsung. While the deal could widen the lead distance between Broadcom and other major semiconductor companies, Broadcom’s past business practices suggest that the company tends to quickly dispose product divisions regarded as redundant as to boost its overall operational efficiency. Therefore, the fate of the NXP facilities will affect the landscape of semiconductor market. The outcome depends on whether Qualcomm will be able to maintain its deal with NXP even as it is being acquired by Broadcom, which will then decide to use or sell the facilities.

Subject

Related Articles

Related Reports