According to the latest report by WitsView, a division of TrendForce, the shipments of gaming monitor (with a frame rate above 100Hz) would reach 5.1 million units in 2018, an annual growth of 100%.

Anita Wang, senior research manager of WitsView, points out the gaming market has been expanding, with video games included in Asian Games this year as a demonstration sport. The gaming sector has provided new momentum to the PC industry, and has driven the upgrade and replacement demand for peripherals. Particularly, a wave of replacement purchase among Internet café in China after PlayerUnknown's Battlegrounds, a popular video game, suggests using monitors with a frame rate over 144Hz for playing in 2017. Since then, gaming monitors with high frame rates have been gradually favored by common game players.

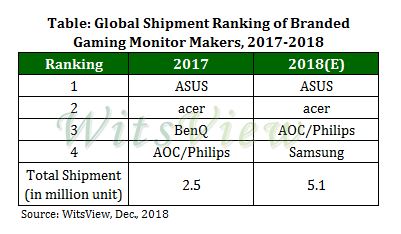

In the global shipment raking of gaming monitor makers, ASUS and Acer retained their first and second spot respectively, while other manufacturers in the ranking have undergone a market shuffle. This year, many LCD monitor makers have entered the gaming monitor market which has high gross margins. The market has also witnessed growing sales of curved gaming monitors with a high performance-price ratio.

ASUS remains the leader in gaming monitor market, with the highest shipments and market share. The company continues to develop innovative products and to increase its investment in the gaming market to retain its leading position.

Acer is in the second spot, with a wide range for gaming products, covering both professional players and general players. The layout has enabled Acer to catch up with its rivals since 2017 although the company started later than ASUS and BenQ. Acer, whose shipments surpassed BenQ and ranked in the second in 2017, will retain its 2nd position this year with shipments even closer to Asus.

AOC/Philips, ranking the third, has been building its brand in the gaming sector. The results turned out to be positive, with rising sales of its gaming products. In addition, the company’s comprehensive product range and the popularity of curved products also helped drive sales. In terms of overseas market, AOC/Philips has also made breakthroughs in Europe and the Asia Pacific in addition to the Chinese market.

Samsung has moved to the fourth in the ranking, one spot upward from last year. Samsung’s gaming monitors are mainly curved models with a high performance-price ratio, providing a comprehensive product line of curved models covering all screen sizes. More than 95% of the gaming products shipped by Samsung this year are curved ones.

For the whole gaming market, the market share of curved models has surpassed 50% in 2018, due to the strong demand for SDC curved gaming monitors from China. On the supply front, SDC is also willing to offer attractive prices to drive demand and shipment further. Other than leading brands, MSI and HKC have also benefited from the trend of curved gaming monitors this year, registering impressive shipments. The share of curved models in the gaming sector is expected to be 54%, up from 23% last year. In comparison, the share of flat LCD models is projected to be 46%, down from 77% last year.

Subject

Related Articles

Related Reports